VisitorsCoverage Review: Comprehensive Insights and User Experience

Before embarking on any trip, securing the right travel insurance can be a game-changer. VisitorsCoverage stands out as a hassle-free solution for your travel insurance needs. From comprehensive plans to user-friendly interfaces, it promises peace of mind on your adventures. As a seasoned traveler, I’ve found their services invaluable.

Navigating through their website is a breeze, making it easy to compare different insurance plans tailored to a variety of travelers. Whether you’re on a short vacation or a long-term excursion, VisitorsCoverage offers an option for everyone. The simplicity and clarity of the process help ensure you get the coverage you need without any unnecessary stress.

Customer reviews frequently highlight their outstanding support and ease of use. Insurance is not just about buying it; it’s about feeling secure before and during your travels. With VisitorsCoverage, you’re not just purchasing a policy—you’re guaranteeing peace of mind.

Table of Contents

- Key Takeaways

- Why Choose VisitorsCoverage

- Licensed Experts and Customer Service

- Comprehensive Coverage Options

- Understanding Travel Insurance

- Types of Travel Insurance

- Determining the Right Policy

- Insurance for Every Traveler

- Expats and International Travelers

- Group and Student Insurance Solutions

- Insurance Plans Comparison

- Reviewing Different Plans

- Making an Informed Decision

- Ease of Use and Support

- Navigating the Platform

- Assistance with Claims

- Additional Benefits and Features

- Coverage for Pre-Existing Conditions

- Convenient Purchase Process

- Policy Details and Pricing

- Understanding Deductibles and Limits

- Finding Affordable Options

- Travel Peace of Mind

- Emergency Assistance

- Protection of Valuables

- Book Your Dream Experience

- More Travel Guides

Key Takeaways

- VisitorsCoverage offers a hassle-free solution for travel insurance.

- The user-friendly interface allows for easy comparison of plans.

- Customers appreciate the outstanding support and simplicity.

Why Choose VisitorsCoverage

VisitorsCoverage stands out for its exceptional customer service and wide range of coverage options, making it a top choice for travelers looking for reliable insurance.

Licensed Experts and Customer Service

VisitorsCoverage boasts a team of licensed insurance experts who are ready to help you. These professionals can guide you through selecting the right plan, ensuring you understand all the details. Their expertise provides reliable medical coverage tailored to your needs.

Customer service is a top priority. Positive user reviews highlight the helpful and responsive support team. For example, many users praise the quick assistance they receive, making the insurance process straightforward and stress-free. This support is vital for travelers needing help while on the go.

Comprehensive Coverage Options

VisitorsCoverage offers diverse insurance plans to cover various needs, from short trips to extended stays. You can easily find something that suits your travel plans. The platform is user-friendly, letting you compare different options efficiently.

The plans cover numerous benefits, including emergency medical care, trip cancellation, and baggage loss. This wide range of options ensures that whatever your travel situation, there’s a plan that fits. It’s simple to purchase a policy, and you get the coverage you need right after completing the transaction.

For more details on specific plans and to find one that fits your trip, you can check out the available [coverage plans].

Understanding Travel Insurance

Travel insurance can save you a lot of stress and money by covering unexpected events during your trip. Choosing the right type and understanding what each policy covers is crucial, especially if you have special needs like pre-existing medical conditions.

Types of Travel Insurance

There are several types of travel insurance, each designed to cover different needs. Trip cancellation insurance refunds you if you have to cancel your trip due to unforeseen events, like a family emergency. Medical insurance covers your medical expenses while traveling, which can be crucial if you fall ill or get injured abroad. This can also sometimes include emergency evacuation.

For those who travel with expensive gear, baggage insurance protects their belongings in case they are lost, stolen, or damaged. Travel delay insurance reimburses additional expenses if your trip is delayed. Each policy type offers distinct benefits, so it’s essential to identify what coverage you need before purchasing.

Determining the Right Policy

Choosing the right policy involves assessing your specific needs. For instance, if you have a pre-existing condition, you’ll want a policy that includes medical coverage. Always read the fine print to understand the limits and exclusions.

Think about the nature of your trip. Are you engaging in adventurous activities? Make sure your policy covers those. Also, consider the length of your trip. Long stays may require more extensive coverage than short getaways.

Comparing different plans on platforms like insurance plans can help you find the best option for your budget and needs. Just remember, the cheapest policy isn’t always the best. Prioritize coverage quality to ensure a smooth and worry-free trip.

Insurance for Every Traveler

TravelersCoverage offers insurance options to meet the unique needs of expats, international travelers, groups, and students. These plans ensure you can travel safely without worrying about unexpected health or travel issues.

Expats and International Travelers

Expats and international travelers have different needs compared to typical tourists. You might spend long periods in foreign countries, requiring comprehensive medical and travel insurance. TravelersCoverage provides plans that cater to long-term stays and cover health care needs abroad. These policies can include emergency medical evacuation, hospital stays, and routine healthcare.

Multi-trip plans can save money and hassle for travelers who often cross borders. Some policies even cover pre-existing conditions, which can be crucial for older travelers or those with ongoing health issues.

Group and Student Insurance Solutions

Group travel, whether for business or leisure, demands special insurance considerations. TravelersCoverage offers group insurance plans that cover multiple individuals under a single policy. This can include trip cancellation, medical coverage, and even specific needs like adventure sports protection.

Students studying abroad often need insurance that meets visa requirements and covers unforeseen events. Plans tailored for students typically include coverage for medical emergencies, trip interruption, and even mental health services.

It’s essential to have a reliable insurance plan when you travel, whether alone, with friends, or for study purposes. TravelersCoverage has plans that make sure you’re covered, no matter your journey details.

Insurance Plans Comparison

Choosing the right travel insurance can be a bit overwhelming. Comparing different plans helps you make an informed decision for your next trip.

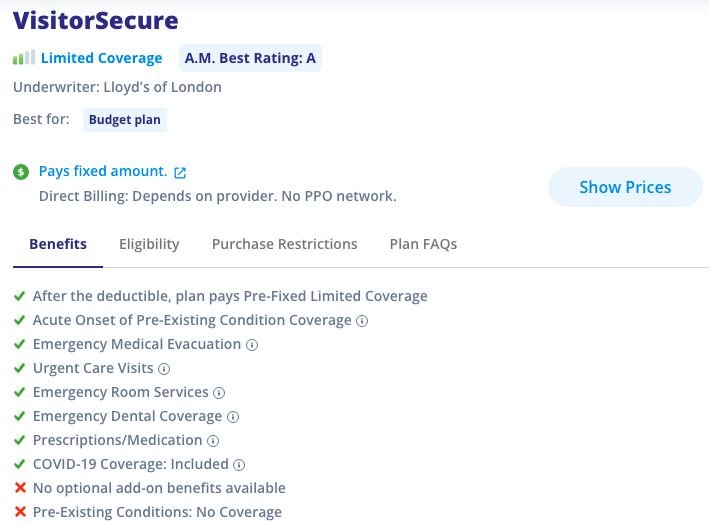

Reviewing Different Plans

VisitorsCoverage offers a variety of insurance plans to suit different needs. For business travelers, the Patriot Multi-Trip and Atlas Multi-Trip plans are popular. These plans provide coverage for multiple trips within a year.

A comprehensive visitor insurance plan might be more suitable if you’re a non-U.S. resident traveling to the United States. Plans like Liaison Travel Plus offer extensive coverage for unexpected injuries or illnesses during your stay. Prices can vary, so it’s important to request a quote to find an affordable plan that fits your budget.

Comparing plans on the VisitorsCoverage website is quite simple. You can see policies side-by-side, looking at what each offers regarding coverages, deductibles, and exclusions. This makes choosing the right plan for your specific travel needs easier.

Making an Informed Decision

When choosing your travel insurance, consider what type of coverage is most important to you. Are you looking for medical coverage, trip cancellation, or both? The fine print matters, so read through policy details carefully.

An important factor is pricing. While you want an affordable plan, you also want to ensure it provides adequate coverage. Request quotes for the plans you’re considering to compare the costs directly.

Another tip is to read customer reviews. VisitorsCoverage has received high ratings, with averages of 4.8 out of five stars on Trustpilot. This can give you confidence in their service and support. If you’re a student seeking health insurance, you could explore the specific insurance options for students.

Ease of Use and Support

VisitorsCoverage aims to simplify the travel insurance process with an easy-to-use platform and robust customer support. The platform allows users to quickly find what they need, and help is always handy when dealing with claims.

VisitorsCoverage‘s website is designed with user-friendliness in mind. The interface is clear and concise, making it easy to explore different insurance options.

You can filter results based on your specific needs, like destination or trip duration. This helps narrow down choices quickly. The platform also provides comprehensive comparisons of plans to assist in making decisions.

If you need help, the website has chat support to answer questions on the spot. This feature makes it much easier to get real-time assistance without hunting through FAQs. For further queries, don’t hesitate to reach out via phone or email; the response time is generally fast.

Assistance with Claims

One critical aspect of any insurance service is claim assistance, and VisitorsCoverage excels in this area. Filing a claim can often be stressful, but their customer success team and claims assist specialists offer steadfast support.

The instructions for filing a claim are straightforward. You get step-by-step guidance, so it’s hard to go wrong. If problems arise, customer service is ready to jump in and help resolve issues. They are dedicated to making the claims process as painless as possible.

In particular, their fast response times to claims inquiries set them apart. Whether through email or phone, the help provided is thorough and prompt. This can make a significant difference when dealing with travel mishaps.

Additional Benefits and Features

VisitorsCoverage offers several notable benefits and features that make it a compelling choice for travel insurance. It is especially useful for travelers with specific needs, such as coverage for pre-existing conditions and a convenient purchase process.

Coverage for Pre-Existing Conditions

One remarkable feature of VisitorsCoverage is its coverage for pre-existing conditions. This can be a game-changer for travelers who worry about existing health issues. The company provides plans that include acute onset of pre-existing conditions, which means that if an existing condition suddenly flares up, you won’t be left uncovered.

This is especially vital for older travelers or those with a chronic illness. Make sure to read the policy details to understand the terms, as different plans might have varying levels of coverage and stipulations. Before purchasing, it’s always best to check and confirm what is included in your specific plan.

Convenient Purchase Process

Another standout feature is VisitorsCoverage’s convenient purchase process. Their website is designed to be user-friendly, helping you easily navigate different plans. You can compare various benefits and features side by side, which makes it simpler to find the right plan for your needs.

The application process can be completed online, and VisitorsCoverage offers multiple customer support options, such as chat, email, and phone support. This makes it easy to get answers to any questions you might have. Buying travel insurance can sometimes be daunting, but VisitorsCoverage aims to make it as stress-free as possible.

Policy Details and Pricing

Travel insurance policies from VisitorsCoverage offer a range of coverage types and pricing options. Let’s break down some important aspects, including deductibles, limits, and finding affordable plans that suit your needs.

Understanding Deductibles and Limits

Deductibles are the amount you pay out of pocket before your insurance kicks in. With VisitorsCoverage, you can choose different deductible options that impact your premium. Higher deductibles usually mean lower premiums, which might save you money upfront.

Coverage limits define the maximum amount the insurance will pay. These are important because they protect you from high costs in case of serious incidents. Make sure you understand these limits to avoid unexpected expenses during your trip. Policies offer various coverage limits, allowing you to pick one that best matches your risk tolerance.

Finding Affordable Options

To find the best travel insurance plan that fits your budget, compare different plans and prices. Look for affordable options without compromising essential coverage. You can explore a variety of plans and customize options to match your travel needs. This way, you ensure you’re not overpaying for unnecessary coverage.

Some plans might have lower premiums, but reading the fine print is crucial. Sometimes, cheaper isn’t better if it exposes you to significant risks. You can find a balance between cost and coverage by reviewing different options and understanding what each plan offers. Explore travel insurance plans and see which one works best for you.

Travel Peace of Mind

Travel insurance aims to cover emergencies and protect your belongings during your journey. Whether you need medical evacuation or want to ensure your valuables are safe, having the right insurance can make all the difference.

Emergency Assistance

Traveling can sometimes bring unexpected health issues or accidents. In these moments, emergency assistance is crucial. Insurance like VisitorsCoverage often includes emergency medical evacuation, which is vital if you need immediate transport to a healthcare facility. Imagine being in a remote location with limited medical facilities—this coverage ensures you get the medical attention you need quickly.

Medical emergencies aren’t the only concern. Accidents or sudden illnesses can also strike. Emergency assistance usually offers help with things like finding local medical services or arranging for your return home if necessary. These services give you peace of mind, knowing you have access to care no matter where your travels take you.

Protection of Valuables

Another significant worry when traveling is the safety of your belongings. Losing your luggage or having valuables stolen can make a trip a nightmare. Insurance policies often cover lost luggage, which includes compensating you for missing items and essential purchases while you wait for your belongings to be recovered.

Think about your electronics, jewelry, and other expensive items. Travel insurance can help protect these valuables from theft or damage, ensuring you’re not stranded without your essentials. With this protection, you can focus on enjoying your trip rather than stressing over lost or stolen items.

Ensuring both emergency assistance and protection of valuables means you’re well-covered, allowing you to travel confidently.

Solace

Hey fellow travelers! I’ve been eyeing VisitorsCoverage for my upcoming trip to Amsterdam, and this review’s got me intrigued. Anyone here used them before? I’m especially curious about their [user experience](https://www.travelblogadvice.com/communication/how-to-generate-more-discussion-and-comments-on-your-travel-blog/) – is the interface really as user-friendly as they claim? Also, for those who’ve filed claims, how smooth was the process? I’m a bit of a worry-wart when it comes to travel insurance (learned that lesson the hard way!), so I’d love to hear some real-world experiences. Oh, and while we’re at it, any insider tips for staying near the Tivoli Doelen? Cheers!