How to Earn Airline Miles Without Flying: 7 Expert Secrets Frequent Flyers Won’t Tell You

Think racking up airline miles means you have to spend half your life in airports? Nope. You can actually earn a surprising number of airline miles from your couch—using credit cards, online shopping, and even things as mundane as dining out or booking a hotel. The real thrill, honestly, is in chasing down these weird little hacks that most travelers never even notice.

I’ve landed free flights just by buying groceries, paying my electric bill, and clicking through a shopping portal before splurging on gifts. It’s kind of nuts how many ways you can build up miles without ever boarding a plane.

Ready to turn your everyday routine into free travel? Let’s dig in.

Table of Contents

- Key Takeaways

- Understanding Airline Miles and Frequent Flyer Programs

- How Airline Miles Work

- The Role of Loyalty Programs

- Types of Mileage Programs

- Best Credit Card Strategies for Earning Airline Miles

- Choosing Travel Rewards Cards

- Maximizing Welcome Bonuses

- Everyday Purchases and Bonus Categories

- Co-Branded Airline Credit Cards

- Leveraging Shopping Portals for Extra Miles

- Top Online Shopping Portals

- Earning with Holiday and Seasonal Offers

- Exclusive Merchant Promotions

- Everyday Spending Activities That Earn Airline Miles

- Dining Rewards Programs

- Grocery and Retail Purchases

- Using Rideshare and Delivery Services

- Earning Airline Miles Through Travel Partners

- Hotel Loyalty Programs

- Car Rental Partnerships

- Booking Cruises, Villas, and Experiences

- Banking, Mortgage, and Financial Services for Miles

- Mileage-Earning Bank Accounts

- Mortgage Partnerships and Other Financial Products

- Maximizing Miles with Special Promotions and Offers

- Referrals and New Member Bonuses

- Limited-Time and Partner Offers

- Creative and Niche Ways to Accumulate Airline Miles

- Surveys, Sweepstakes, and Charitable Giving

- Shopping with Specialty Partners

- Transferring Points and Maximizing Redemptions

- Credit Card Reward Points Transfers

- Hotel and Bank Partner Transfers

- Unlocking Elite Perks and Status Without Flying

- Achieving Elite Status through Spend

- Status Match and Fast Track Programs

- Personal Finance Tactics for Frequent Flyer Miles

- Optimizing Everyday Bills for Miles

- Cell Phone and Utility Payments

- Monitoring Offers and Maximizing Value

- Airline-Specific Opportunities and International Programs

- American Airlines AAdvantage Exclusive Ways

- Delta SkyMiles and United MileagePlus Partnerships

- Participating in Global Airline Programs

- Frequently Asked Questions

- What are some unconventional methods to accrue airline miles?

- Can you leverage hotel stays to gain airline miles, and if so, how?

- Is it possible to earn airline miles through everyday shopping, and what are the best strategies?

- Are there any dining programs that allow earning of airline miles, and how do they work?

- How can one utilize credit card sign-up bonuses to rapidly increase airline miles?

- What strategies exist for earning airline miles through entertainment and leisure activities?

- Book Your Dream Experience

- More Travel Guides

Key Takeaways

- You can earn airline miles without flying.

- Everyday spending and online shopping are your secret weapons.

- Picking the right credit card and partner deals matters more than you think.

Understanding Airline Miles and Frequent Flyer Programs

You don’t need to be a business traveler or a jet-setter to make airline miles work for you. Airline rewards programs are way more flexible than most people realize, and if you get the basics down—even if you never leave your zip code—you’ll start seeing chances to rack up miles everywhere.

How Airline Miles Work

When folks chat about “airline miles,” they’re usually talking about a loyalty currency. Despite the name, miles rarely match the actual distance you fly. Sometimes, you’ll earn them based on how much you spend, not how far you travel.

I remember when I joined my first frequent flyer program—I expected everything to be about flights. But honestly, I earned more miles from my daily spending than I ever did in the air. Using a branded credit card and shopping through partner stores let me stack up points fast. You can trade these “miles” for flights, upgrades, hotels, or even gift cards, depending on the airline.

One year, I paid my bills with a travel credit card and did my holiday shopping through an airline portal. By the end of the year, I’d scored a round-trip flight—no paid tickets required. If you’re clever about it, you can collect miles just by tweaking your usual habits.

The Role of Loyalty Programs

Frequent flyer programs are the backbone of earning airline miles. You sign up (usually for free), and the airline tracks your activity with an account number. At first, it feels like just another signup, but if you stick with it, the miles can snowball.

Smart travelers zero in on programs that match their travel goals, or even better, airlines that partner with others they might fly someday. U.S. airlines belong to huge alliances, so you can earn and redeem miles with dozens of partners—even if you rarely fly the airline you signed up with.

I always recommend picking a loyalty program that aligns with your biggest trips or the places you dream of visiting. Don’t forget to look at their partners too. Some of my favorite trips came from using miles on airlines I never thought I’d fly—like the time I booked a ticket to Asia with miles earned on a U.S. card.

Types of Mileage Programs

Not all mileage programs play by the same rules. Some are “distance-based,” others are “revenue-based,” and a few mix it up. Distance-based programs award miles for how far you fly. That used to be the norm, but nowadays, most airlines switched to revenue-based: you get points for every dollar you spend.

I learned this the hard way—joined a distance-based program, booked a crazy-cheap ticket, and barely earned any miles. Now, I pay attention to what actually earns me points. Some programs even let you earn on hotel stays, car rentals, or using certain credit cards.

Programs like American Airlines AAdvantage or United MileagePlus mix both methods, sometimes tossing in bonuses for elite status. Picking a program that matches your spending style can make a world of difference.

Here’s a quick table for reference:

| Program Type | How Miles Earned | Best For |

|---|---|---|

| Distance-Based | Miles flown | Long flights, high fares |

| Revenue-Based | $ spent on airfare | Big spenders, frequent buyers |

| Hybrid | Combination of both | Flexible travelers |

Always read the fine print. I’ve gotten burned by assuming a program worked one way when it actually didn’t. Poking around airline websites or travel forums before joining can save you a headache.

Best Credit Card Strategies for Earning Airline Miles

These days, you can earn a healthy stash of airline miles without ever stepping on a jet bridge. Credit cards do most of the heavy lifting—if you use them right.

Choosing Travel Rewards Cards

Picking a travel credit card can feel overwhelming. There are tons of choices, but my go-to advice: look for cards that earn flexible points or miles, not just ones tied to a single airline. Cards like the Chase Sapphire Preferred or Amex travel cards let you transfer rewards to multiple airline partners, which is a lifesaver for flexibility.

Let’s be real—most of us aren’t loyal to one airline. With a flexible card, you can chase the best deals, whether you end up flying Delta, United, or Alaska. Pay close attention to annual fees and make sure the perks make sense for your lifestyle.

Perks like travel insurance and no foreign transaction fees have bailed me out more than once. Don’t ignore those extras.

Maximizing Welcome Bonuses

Welcome bonuses are where things get interesting—and a little tricky. Most travel cards dangle a big bonus if you spend a certain amount in the first few months. I’ve flown roundtrip to Europe on a single sign-up bonus, so don’t underestimate these offers.

The trick? Only apply when you’ve got some big expenses on the horizon. Don’t overspend just to hit the bonus. And always pay your bill in full—otherwise, those “free” miles get expensive fast.

Everyday Purchases and Bonus Categories

Here’s where most people leave money on the table. You can earn miles just by shifting your daily spending to the right card. Most cards offer bonus miles for categories like groceries, gas, dining, or travel.

If you eat out a lot or hit the grocery store every week, pick a card that rewards you for those habits. I’ve grabbed my “grocery” card for everything from toothpaste to socks—bonus points are bonus points.

Example of Common Bonus Categories

| Category | Typical Bonus Rate (per $1 spent) |

|---|---|

| Dining | 2-3x points/miles |

| Travel | 2-5x points/miles |

| Groceries | 1-4x points/miles |

Check your card’s benefits and line them up with your spending habits. It’s the easiest way to supercharge your miles.

Co-Branded Airline Credit Cards

If you’re a loyalist—maybe you live near a Delta hub or always fly Southwest—co-branded airline cards can be a solid bet. Cards like the American Airlines AAdvantage, Delta SkyMiles, or United Explorer earn miles directly with that airline, often at higher rates.

The perks are what really sell me. Free checked bags, early boarding, anniversary miles, and sometimes even a shortcut to elite status. These little extras can make a big difference, especially if you travel light or want to skip the check-in line.

Just make sure the card matches your flying patterns. If you rarely fly United, don’t bother with a MileagePlus card. But if you stick to one airline, these cards make earning miles a breeze.

Leveraging Shopping Portals for Extra Miles

Shopping portals are an underrated way to squeeze more airline miles from your everyday online spending. If you pick your sites and timing right, you can rack up points faster than you’d expect—often for stuff you planned to buy anyway.

Top Online Shopping Portals

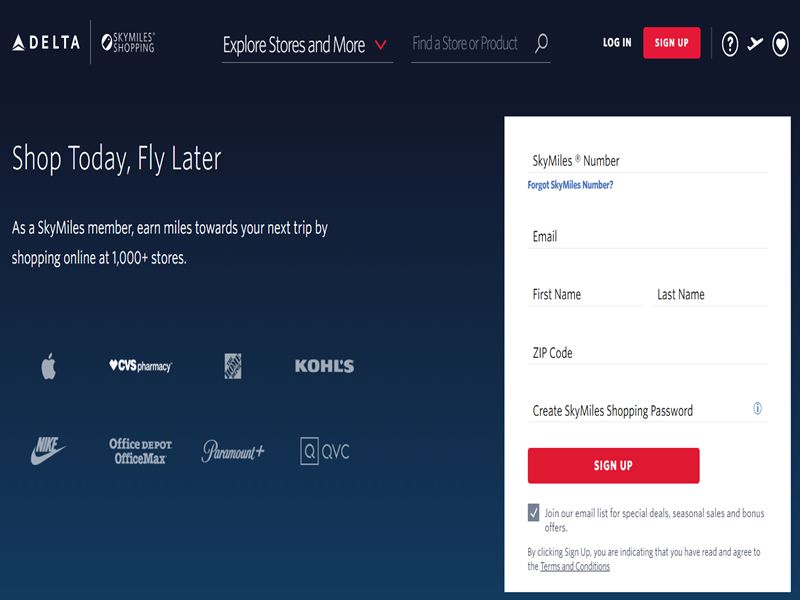

Most big airlines—American, Delta, United, Southwest—run their own shopping portals. You log in, click through to a retailer (think Amazon, Ticketmaster, or Macy’s), and shop as usual. The portal tracks your purchase and deposits miles in your account.

Some portals have better deals than others. For instance, American Airlines’ portal sometimes offers 1-4 miles per $1 at certain stores, while Southwest’s Rapid Rewards Shopping might toss out bonus deals that beat the rest. I usually stick with airlines whose miles I value most, but I’ll check a comparison site if I’m making a big purchase.

Stick to brands you already trust. Not every Amazon product earns miles, so always check the details. I keep shortcuts to my favorite portals in my browser so I don’t forget before a big buy.

Earning with Holiday and Seasonal Offers

Shopping portals go wild around the holidays. Black Friday, Cyber Monday, and back-to-school sales are packed with limited-time bonuses. I’ve seen deals like “spend $250, get 1,000 bonus miles.” Last December, I covered a domestic flight just by doing my usual gift shopping.

Watch for flash deals—they sometimes last only a day or two. Sign up for email alerts from your favorite airline’s portal so you don’t miss out. Sometimes it pays to make one big purchase instead of several small ones to hit a bonus.

These promos aren’t just for big-box stores. I’ve found offers for concert tickets, beauty products, clothing, and even subscription boxes during seasonal sales. With a little strategy, your mileage balance can grow surprisingly fast.

Exclusive Merchant Promotions

Some retailers launch exclusive bonus deals with airline portals. You might see a banner for “6 miles per $1 at [Retailer] this week only.” I never skip these, even if it means changing my shopping plans. The bonus multipliers can be huge.

One time, I bought concert tickets during a double-miles event on Ticketmaster—easy way to pocket hundreds of bonus miles. Electronics and tech shops often run similar promos around new product launches.

Check the “Featured Offers” or “Bonus Deals” section on the portal’s homepage. These change all the time, so check back often. Always read the terms—sometimes you need a code or have to buy within a short window to qualify. That’s how you quietly build your mileage stash with hardly any extra effort.

Everyday Spending Activities That Earn Airline Miles

You don’t need to book a flight to watch your mileage balance tick upward. Normal purchases—groceries, rideshares, even takeout—can quietly bulk up your airline account with almost zero extra effort.

Dining Rewards Programs

Ever wish your lunch runs could land you a free trip? Dining rewards programs are honestly one of the best under-the-radar hacks out there. Major U.S. airlines—think American, Delta, United—all have these dining program partnerships.

You just sign up, link a credit or debit card, and every time you use that card at a participating restaurant, you start earning miles.

Here’s the beauty: you don’t have to change your routine. Eat out, pay as usual, and those points usually show up in your account within a few days.

I’ve stacked up thousands of airline miles just from grabbing burgers or meeting friends for sushi. Some programs even toss in bonus miles if you write a review after your meal—easy win, if you ask me.

Here’s a tip: stick to one card for dining, and if you can, link it to multiple dining rewards programs. Some restaurants show up in more than one, but you’ll only get miles from one airline per card, so pick your favorite and let the miles roll in.

Grocery and Retail Purchases

Did you know your weekly grocery run could quietly build your mileage stash? Some airlines let you earn miles when you shop through their online malls, with big names like Target, Walmart, and Best Buy in the mix.

Instead of going straight to the store’s website, hit the airline’s shopping portal first, then click through to your shop of choice.

You earn miles for every dollar you spend. I’ll admit, I forget this trick half the time, but even Starbucks and Home Chef sometimes offer bonus points if you reload a card or sign up through the portal.

Keep an eye out for special offers—sometimes you can snag double or triple miles during promos or holidays.

Another pro move: use a credit card that already gives you points for groceries or retail. That way, you’re stacking card points and airline miles at once.

No extra effort, double the rewards. Why not?

If you’re like me, you use Lyft or Uber all the time—and those rides can rack up miles if you play it right. Several airlines partner with Lyft (and sometimes Uber), so when you link your frequent flyer number to your rideshare account, you earn miles with every ride.

Delivery services like Uber Eats sometimes join in through airline portals or special deals. I once earned enough miles for a short flight just from a few months of food deliveries—seriously, just by paying through the right portal.

Check your airline’s site for current deals; they pop up and disappear fast, so jump in when you see them.

You’ll usually get a set number of miles per dollar spent. If you’re ordering food or grabbing rides regularly, those miles add up faster than you’d think.

And who doesn’t love scoring airline miles with their Friday night pizza?

Earning Airline Miles Through Travel Partners

You don’t have to step foot on a plane to rack up miles. There are plenty of ways to earn them on the ground, and with a bit of planning, you can boost your balance through hotels, rental cars, and even experiences.

Hotel Loyalty Programs

When you book hotels—especially with big brands or loyalty programs—you can often choose to earn airline miles instead of hotel points. Hilton Honors, Marriott Bonvoy, and IHG Rewards all let you link your frequent flyer account, so you can pick up miles with each qualifying stay.

Some programs toss in bonuses during promos, and those can appear without much notice.

If you’re not loyal to one chain, check out partners like Rocketmiles and Pointshound. They’ll reward you with miles at hundreds of properties, which is perfect for weekend getaways or when you want something different.

I’ve earned thousands of miles this way, and honestly, it feels way easier than flying cross-country. And if you like variety, keep an eye out for Booking.com deals that sometimes tie into frequent flyer promos.

Car Rental Partnerships

Don’t overlook car rentals—companies like Hertz, Avis, and Budget all partner with airlines. Add your frequent flyer number to your rental, and watch the miles pile up.

Some promos offer up to 2,000 miles per rental, just for driving around on your trip.

If you’re into peer-to-peer rentals like Turo, keep an eye out for special mileage deals with select airlines. Always double-check before booking, since not all rates qualify for bonuses.

One hard-learned lesson: prepaid or discounted rates often don’t count, so always read the fine print! If you want to compare options, hotels & car hire searches make it easy to spot partnerships that earn you extra miles.

Booking Cruises, Villas, and Experiences

Miles aren’t just for hotels or cars—you can earn them on cruises, villa stays, even tours. Some cruise lines link up with frequent flyer programs, so booking select cruises and providing your number can net you a nice chunk of miles.

Promos pop up on airline or cruise partner pages, but they’re not always advertised elsewhere, so you’ll want to check directly.

Luxury villa companies like Villas of Distinction sometimes team up with airlines, too. If you’re planning a splurge or a group trip—maybe a family reunion—it’s worth a look.

Even Vrbo rentals occasionally have tie-ins, especially if you book through a frequent flyer portal.

Don’t skip out on earning miles from experiences. Booking tours or activities through partners like Viator can come with mileage bonuses during promotions.

If you’re already splurging on a city tour or a skip-the-line ticket, you might as well get a few hundred miles back. It adds up, trust me.

Banking, Mortgage, and Financial Services for Miles

You don’t need to travel to earn miles—sometimes, just moving your money smartly can help you build up your next trip’s fund.

Mileage-Earning Bank Accounts

Some banks have gotten creative and now offer airline miles instead of boring old interest. Take Bask Bank, for example—they’ll give you American Airlines AAdvantage miles for every dollar you keep in your savings.

So if you park $10,000 in their account, you’ll see your mile stash grow instead of just collecting a few bucks in interest.

Honestly, it’s way more fun to watch your mileage balance climb. Opening an account is pretty straightforward, but always check the fine print for fees or withdrawal restrictions.

Sometimes they’ll throw in bonus miles for big deposits when you open the account, almost like a mini sign-up bonus.

Not a bad way to build a travel fund while growing your savings.

Mortgage Partnerships and Other Financial Products

Here’s a trick most people miss: some companies actually hand out airline miles for big money moves, like taking out a mortgage or refinancing your home.

It’s not a secret handshake deal—these promos are out there if you look. Rocket Mortgage and Guaranteed Rate have both offered serious miles in the past, sometimes 25,000, 50,000, or more for closing a mortgage or refinancing.

That’s enough for a round-trip ticket on some airlines, just for paperwork you’d have to do anyway. Don’t pick a lender only for the miles, though—a bad rate can wipe out any rewards.

If you’re already shopping around, check for the latest airline partner offers and see if you can snag a bonus for something you’re doing anyway.

You’ll sometimes see offers for opening a brokerage account or taking out a personal loan, too. Airlines and banks keep getting more creative, I’ll give them that.

Keep your eyes peeled for limited-time promos and try to stack them if you can. Turning boring paperwork into an adventure fund? That’s a win.

Maximizing Miles with Special Promotions and Offers

If you want to rack up miles beyond flying, it’s all about catching the right offers at the right time. There are plenty of surprisingly easy ways—referrals, quick-hit promos, and more.

Referrals and New Member Bonuses

Ever see those “Refer a friend and you both get rewarded” deals? They can be mini goldmines for airline miles. Most big airlines—American, Delta, United—run referral programs.

Share your sign-up link with friends or family, and if they join, you both score. Sometimes it’s 1,000 miles, but special promos can bump that up to 5,000 or even 10,000.

New member bonuses are another easy win. Airlines roll them out all the time, but they don’t always shout about it. A friend of mine picked up 2,500 bonus miles just for enrolling and completing a quick “SimplyMiles” offer.

If you’re joining a program, always hunt for a “Welcome Offer” or promo code. It’s a quick way to pad your account, and honestly, it feels great seeing those miles appear—no airport required.

Limited-Time and Partner Offers

Here’s where it gets fun: always watch for limited-time promos. I’ve racked up extra miles just by making purchases I was going to make anyway, but through an airline’s partner link.

Airlines team up with all sorts of retailers, from coffee shops to streaming services. American Airlines’ SimplyMiles platform, for example, often hands out big bonuses for shopping at partner stores or signing up for a trial.

Sometimes, you’ll see milestone rewards—spend a certain amount with their credit card partners or book a partner hotel, and you get a pile of extra miles.

Here’s a quick table to keep things straight:

| Offer Type | What You Do | Potential Reward |

|---|---|---|

| Shopping Portal | Buy from retailer via airline | Up to 10x miles/dollar |

| Credit Card Milestone | Hit spend target | Extra bonus miles |

| Partner Services | Sign up/try service | One-time miles boost |

Honestly, signing up for airline emails is worth it—even if they annoy you. The best bonus offers I’ve scored came from those “flash sale” alerts I almost deleted.

And who wants to miss a 24-hour-only deal that could get you closer to your next trip?

Creative and Niche Ways to Accumulate Airline Miles

Sometimes, the best airline mile sources are the ones nobody talks about. There are quirky, lesser-known ways to build your mileage stash—no boarding pass needed.

Surveys, Sweepstakes, and Charitable Giving

Surveys are one of my favorite lazy-day hacks for picking up stray miles. Programs like e-Rewards or Miles for Opinions let you earn miles for answering simple online surveys.

Each survey only gets you a few miles, but they add up if you’re lounging on the couch.

Sweepstakes are another oddball route. Airlines sometimes run contests where you can win miles just by entering or joining a mailing list. Odds aren’t great, but it costs nothing, so why not?

You can even earn miles by giving back—a few airlines partner with charities like Stand Up To Cancer. If you donate through their portal, you get a handful of miles, plus you’re helping out a good cause.

It’s a small thing, but it feels good to do some good and inch closer to your next trip at the same time.

Shopping with Specialty Partners

It’s kind of wild, but you really can earn miles just by shopping—if you know where to poke around. Most airlines have these online “shopping malls” packed with retailers, but honestly, the more offbeat partners are where things get interesting and most folks never even notice them.

Wine clubs come to mind right away. Take Vinesse Wine—they team up with airlines like American and toss a pile of miles your way when you order your first box. I gave it a shot once, mostly out of curiosity, and the wine was surprisingly drinkable. Plus, I scored enough miles to nearly snag a free domestic flight.

There’s more if you dig a little. Ever stumble on Emergency Assistance Plus? That’s a travel medical and security membership, and sometimes if you sign up through an airline’s promo, you’ll see a nice bonus of miles drop into your account. Even paying your utility bills or grabbing dinner at certain local spots can earn you miles—if you remember to go through the airline’s portal.

So, next time you’re shopping or considering a new subscription, check if there’s a hidden airline partner deal. Those little surprises add up faster than you’d expect.

Transferring Points and Maximizing Redemptions

You can rack up airline miles without ever flying, but the real trick is knowing how to shuffle points around and squeeze more value from them. Sometimes, it’s less about hoarding points and more about using them in a way that makes you wonder, “Wait, can I really do that?”

Credit Card Reward Points Transfers

If you’ve got a travel credit card, you might be sitting on a stash of points you didn’t even realize could become airline miles. Cards like Chase Ultimate Rewards let you earn points on daily stuff—groceries, gas, even your morning pastry run. Here’s the kicker: those points aren’t stuck with your card company.

Most people miss that you can transfer these points straight to partner airlines. Just log in, pick your airline, and—boom—your points turn into miles, sometimes within minutes. It’s a game-changer if you spot a last-minute deal on United or British Airways but your airline account looks a little sad.

I once transferred Chase points to United for a Hawaii trip right in the middle of a promo. It felt like I’d hacked the system, but it was all above board. One tip: always check if transferring gives you the best deal. Sometimes booking through the card’s travel portal is smarter, and not all transfer rates are created equal. Don’t rush—do a quick side-by-side before you pull the trigger.

Hotel and Bank Partner Transfers

Don’t overlook your hotel points, either. Programs like Marriott Bonvoy or Hilton Honors let you turn hotel stays into airline miles—though, honestly, the transfer rates can be a bit meh compared to bank points. Occasionally, though, you’ll find transfer bonuses that make it worthwhile.

I once dumped a bunch of Marriott points into Alaska Airlines during a bonus week and squeezed out a roundtrip ticket. If you’ve got leftover hotel points after a trip, poke around for transfer options. Sometimes those “orphaned” points get you closer to a flight than you’d think.

Always double-check transfer ratios and see if it makes sense. Banks like Chase and Amex have a whole buffet of airline and hotel partners, so you’ve got options. But don’t get caught up in just chasing the best math—timing and your actual travel plans matter just as much. That’s something a lot of folks overlook.

Unlocking Elite Perks and Status Without Flying

Let’s be honest—airline elite status feels out of reach if you’re not living at the airport. But with a few clever moves, you can grab perks like priority check-in or complimentary upgrades without ever scanning a boarding pass.

Achieving Elite Status through Spend

A good airline credit card can do more than just rack up miles for your next trip—it can actually push you into elite status territory, just by spending on stuff you already buy.

Use a co-branded airline card for your daily purchases—groceries, utility bills, maybe even that daily coffee run—and you’ll earn elite-qualifying points. Airlines like Delta and United let you hit status levels just by spending enough in a year. Some cards even fast-track you to perks once you cross a certain threshold, like $25,000, unlocking things like preferred seats or free checked bags.

Here’s a quick peek at what you might unlock:

| Status Level | Common Perks |

|---|---|

| Silver | Priority check-in, seat selection, free bags |

| Gold/Platinum | Free upgrades, lounge access, better support |

If the idea of living on credit makes you cringe, I get it. But even just putting your routine bills and a few splurges on the card can open doors usually reserved for the road warriors.

Status Match and Fast Track Programs

Already have elite status with a hotel, car rental, or another airline? You can often “status match” with airlines and jump the line—no flights required.

I matched a hotel loyalty tier once and, suddenly, I was breezing through airport check-ins before my next trip even started. Some airlines also run “fast track” challenges, letting you earn status with just a handful of qualifying activities—sometimes even just spending.

If you spot a status match promo, gather your existing cards or account screenshots and apply with the airline. Perks like priority boarding or upgrades usually show up pretty quickly. Just watch the fine print—there might be a time limit or a requirement to prove you’re still active with your original program.

Don’t be shy about asking, either! Airline reps sometimes have hidden promos or will offer an unpublished match if you mention upcoming travel. Sometimes all it takes is a friendly message and proof you’re loyal somewhere else.

Personal Finance Tactics for Frequent Flyer Miles

With a little creativity, you can turn your everyday spending into a steady stream of frequent flyer miles. It’s not just about credit cards—it’s about making your money work for you in ways most people never think about.

Optimizing Everyday Bills for Miles

You probably swipe your card for groceries, gas, or coffee without thinking twice. But if that card earns airline miles, every purchase gets you closer to a free flight. I started putting my rent and insurance on a miles-earning card and couldn’t believe how fast the points added up.

Here’s what you can usually pay with a miles card:

| Bill Type | Can Usually Earn Miles? |

|---|---|

| Groceries | ✔️ |

| Gas/Transport | ✔️ |

| Streaming Services | ✔️ |

| Rent/Mortgage | Sometimes (via apps) |

| Insurance | ✔️ |

Set up payment alerts so you don’t miss due dates—late fees wipe out your gains fast. If you’re strategic, those routine expenses can shave a big chunk off your next trip’s cost.

Cell Phone and Utility Payments

Here’s a sneaky one—not everyone realizes you can sometimes earn miles by paying your cell phone and utilities. It depends on your provider, but many utility and internet companies now let you pay with a credit card. Most major phone carriers do, too.

Some airline programs even partner with utility companies, so you earn miles just for keeping the lights on. For example, switching to a specific energy provider could net you a bonus of thousands of miles. If your provider doesn’t take cards, try a third-party payment service—sometimes there’s a small fee, but the miles can still make it worthwhile.

Look at your monthly bills and see what you can shift to a miles-earning card. Suddenly, that new phone plan feels a bit less expensive when you realize it’s helping fund your next getaway.

Monitoring Offers and Maximizing Value

Deals and promos change constantly, and that’s half the fun if you ask me. I make a habit of checking my credit card and airline dashboards for new bonus offers or limited-time promos. Sometimes you’ll get double or triple miles for spending at certain stores or on certain days.

A few tricks I swear by:

- Sign up for shopping portals: Airline portals reward you for shopping with big-name retailers online.

- Use browser plugins: They nudge you to click for extra miles before you check out.

- Stack promos: Combine bonus offers with your card’s points for a bigger haul.

Don’t ignore expiration dates—some deals last only a few days. Make checking for promos a habit, and set up reminders or subscribe to loyalty newsletters so you never miss a chance to boost your miles from your daily routine.

Airline-Specific Opportunities and International Programs

Every airline has its own quirky ways to earn miles without flying. Most travelers miss out on these, but if you’re willing to get creative, you’ll be surprised by how many miles you can collect just by tweaking your habits and watching for partnerships.

American Airlines AAdvantage Exclusive Ways

American Airlines AAdvantage has some sneaky-good ways to pad your account. The AAdvantage eShopping portal is a favorite of mine—just click through before you shop online and you’ll earn bonus miles from hundreds of stores, from Target to Best Buy.

If you love eating out (or, honestly, even just takeout), check out the AAdvantage Dining Program. Link your credit card, and you’ll earn miles every time you pay at a partner restaurant. Sometimes there’s an extra bonus for your first meal.

Here’s a tip most people miss: if you have Hyatt elite status, you can link your AAdvantage and Hyatt accounts to double dip. Every Hyatt stay earns you both hotel points and AAdvantage miles. If you travel for work, this can really stack up.

Don’t sleep on AAdvantage credit cards, either. Beyond the big sign-up bonuses, you’ll earn miles on every purchase. I’ve even scored miles by booking cruises and car rentals through AAdvantage partners.

Delta SkyMiles and United MileagePlus Partnerships

Delta SkyMiles and United MileagePlus have a ton of shopping and lifestyle partners. With Delta, use the SkyMiles Shopping site to earn miles for buying stuff you’d buy anyway—groceries, electronics, you name it. Some days, you’ll find extra bonuses for shopping at specific retailers.

Delta also links up with Lyft, so every ride you take can earn SkyMiles. If you’re always bouncing around cities, this adds up.

United MileagePlus has its own shopping portal, plus hotel and car rental partners. Here’s a quirky one: you can actually earn miles on your utility bills through some United partnerships. I didn’t believe it until I tried it.

You can also transfer Marriott Bonvoy points into MileagePlus. The value isn’t always amazing, but if you’ve got leftover hotel points, it’s better than letting them expire.

Participating in Global Airline Programs

International airline rewards programs can be a goldmine for U.S. travelers who want flexibility. Air Canada Aeroplan lets you transfer Amex Membership Rewards or Chase Ultimate Rewards points and then use them for flights on Star Alliance partners—United, Lufthansa, and more.

Avianca LifeMiles is another hidden gem. You never have to fly Avianca; just buy LifeMiles during sales or transfer from credit card programs. Redemptions can be dirt cheap for certain routes if you keep an eye out for flash sales.

JetBlue TrueBlue has some fun tricks, too. You can earn points for Amazon purchases through their portal. Emirates Skywards and Aer Lingus let you top up your account via credit card transfers and other partnerships, so you can get closer to that bucket-list trip without even leaving your couch.

If you’re heading to the UK, don’t ignore trains like Heathrow Express. You can sometimes earn airline miles just for booking a ticket—always check your airline’s partner page before you buy. It’s a quirky little hack, but trust me, those points add up.

Frequently Asked Questions

You can rack up airline miles by doing way more than just booking flights. Everyday stuff—hotel stays, takeout, online shopping—can all unlock easy miles, and sometimes the best methods are the ones nobody talks about.

What are some unconventional methods to accrue airline miles?

Ever thought about racking up miles just by joining a wine club or grabbing a magazine subscription? Airlines team up with some truly unexpected partners.

Honestly, one of the oddest things I’ve done: I ordered flowers for my mom through an airline’s partner site and snagged a bunch of miles.

You can even earn miles by paying utility bills or renting cars—if you catch the right promotions. If a sign-up bonus pops up and it fits your lifestyle, why not go for it? These quirky little tricks can quietly pile up over the year.

Can you leverage hotel stays to gain airline miles, and if so, how?

Definitely! Lots of hotel chains let you pick airline miles instead of their own loyalty points. This is a solid move if you’re not married to one hotel brand and want a little flexibility.

When you book, look for the option to earn airline miles and enter your frequent flyer number. Some hotels also let you convert existing points to miles later, which is a lifesaver if you’ve got stray points collecting dust.

Is it possible to earn airline miles through everyday shopping, and what are the best strategies?

Shopping portals might just be the easiest way to earn miles without setting foot on a plane. If you’re anything like me and shop online a bit too much, always start at an airline’s shopping portal. Just log in, click through to your go-to store, and you’ll collect miles for stuff you’d buy anyway.

Watch for limited-time bonuses or extra miles for hitting certain spending thresholds. Here’s a tip: install the portal’s browser extension. Sometimes they’ll toss you bonus miles just for using it once. It’s pretty much effortless.

Are there any dining programs that allow earning of airline miles, and how do they work?

This one’s a personal favorite. Airlines run dining programs where you link your credit or debit card, and when you eat at participating spots, you earn miles automatically. No need to remember codes or coupons.

You can even score extra miles by posting reviews after you dine. I’ve stumbled onto some fantastic little restaurants this way. Honestly, earning miles for eating out feels like a cheat code.

How can one utilize credit card sign-up bonuses to rapidly increase airline miles?

Credit card sign-up bonuses are hands down the quickest way to boost your miles balance. Airlines and banks try to reel you in with huge mile offers if you spend a certain amount within a few months.

Just don’t forget to read the fine print and always pay your bill in full. I usually time big expenses, like annual insurance payments, during the sign-up window so I hit the spending requirement without splurging on things I don’t need.

What strategies exist for earning airline miles through entertainment and leisure activities?

Not many travelers realize you can rack up airline miles just by booking concerts, festivals, or even a trip to an amusement park. Airlines often tuck a “things to do” or “experiences” tab away on their websites.

Before you grab tickets for your next night out, poke around those sections. You might find a surprising deal or bonus. I remember picking up a chunk of miles last year after I booked a quirky city tour through one of these airline partner pages.

Keep your eyes peeled for partnerships with streaming services, magazine subscriptions, or even event ticketing platforms. Sometimes, these hidden gems let you earn miles while you’re just relaxing at home or planning a fun outing.

Honestly, a little curiosity goes a long way here. If you’re already spending money on leisure, why not let it nudge you closer to your next free flight?